MIDDLE EAST LOCALIZATION FOR BUSINESS CENTRAL

Xenatus Middle East localization is compliant with local laws and regulations for Saudi Arabia, UAE, Lebanon, Bahrain, Oman and Qatar.

The solution consists of features that help minimize custom development on the platform.

Available on Microsoft AppSource

FEATURES

GCC & SAUDI ARABIA LOCALIZATION

-

Providing the relevant VAT Bus. And VAT Prod. Posting Groups for handling the VAT related transactions.

-

Custom Calc. and Close VAT Settlement process that allows the users to close per Bill-to/Pay-to No and Type of transactions (Purchases/ Sales)

-

Generation of the VAT Return Form

-

VAT Entries Report providing details of the details of the transactions per VAT Return Form cell

-

Custom Printout reports for Posted Sales Invoice and Posted Sales Cr. Memo

-

Custom Journal for posting the Customs Declarations related with VAT.

-

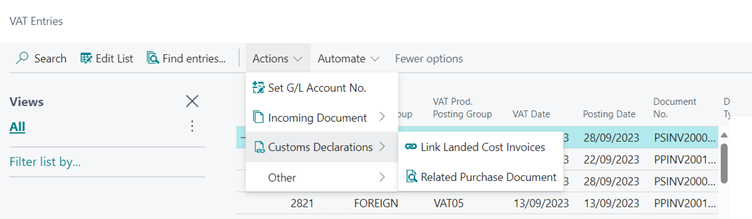

Functionality to link with the Customs Declaration with one or more Purchase Invoices related with the import.

-

Functionality to link the VAT from already posted Customs Declaration to the relevant Landed Cost Purchase Invoices

GCC & UAE LOCALIZATION

-

Providing the relevant VAT Bus. And VAT Prod. Posting Groups for handling the VAT related transactions.

-

Custom Calc. and Close VAT Settlement process that allows the users to close per Bill-to/Pay-to No and Type of transactions (Purchases/ Sales)

-

Generation of the VAT Return Form

-

VAT Entries Report providing details of the details of the transactions per VAT Return Form cell

-

Custom Printout reports for Posted Sales Invoice and Posted Sales Cr. Memo

-

Custom Journal for posting the Customs Declarations related with VAT.

-

Functionality to link with the Customs Declaration with one or more Purchase Invoices related with the import.

-

Functionality to link the VAT from already posted Customs Declaration to the relevant Landed Cost Purchase Invoices

LEBANON LOCALIZATION

-

Providing the relevant VAT Bus. And VAT Prod. Posting Groups for handling the VAT related transactions.

-

Custom Calc. and Close VAT Settlement process that allows the users to close per Bill-to/Pay-to No and Type of transactions (Purchases/ Sales)

-

Custom control on the journals providing mandatory Vendor/Customer data for VAT related transactions

GENERAL CATEGORIES

is the function that adds additional fields to the Master entities of the system. A simple setup can create up to 10 additional fields in the Customers, Vendors, Items, Locations, and Salespeople/Purchases tables. Link these additional fields to Dimensions to synchronize their values and automate the mapping of default dimensions to records.

DIMENSION GROUPS

is a feature that allows the grouping of multiple dimensions. Instead of manually selecting multiple dimension values in a document or journal, simply select a group of dimensions to instantly update all dimension fields. Xenatus Dimension Groups allow you to create up to four-dimension groups.

AUTOMATIC APPLICATION OF CUSTOMER & VENDOR ENTRIES

In any accounting software, it is important to match your customers’ and suppliers’ payments with the corresponding invoices for which the payment was made. This gives you a correct overview of the ageing analysis of your debtors and creditors. With Xenatus Automatic Application Batch Job we ensure that all entries are correctly applied according to the predefined criteria.

TCY TRANSACTION CURRENCY IN GENERAL LEDGER

For companies doing business in more than one currency, it is always essential to have the information available in their general ledger entries.

The TCY feature tracks the actual transaction currency in the G/L entries. Two new columns are created to store the transaction currency code and amount.

SHAREPOINT CONNECTOR

The SharePoint connector provides the ability to attach documents to records, but instead of storing them in the Business Central database, store them in SharePoint. Create a folder hierarchy per company, per record, and per document type.

DocuSign INTEGRATION

Use the familiar eSigning application from Business Central. Send documents such as quotes through DocuSign to get electronic signatures from your customers. Once the document is signed, Business Central retrieves the update and updates the system.

VENDOR RECONCILIATION

Reconciling vendors’ transactions can be a cumbersome task. The vendor reconciliation process can automate the task. Import the vendor transactions from excel and let the system automatically match them. The feature offers manually matching as well!

EXTENDED REPORTS

Within the module, we have added a variety of updated reports as well as brand new reports. The reports cover the financial module, receivables, payables and inventory. In addition, we have added reports on documents such as sales invoices, sales orders and more.

BENEFITS

-

One solution for multiple localizations. Each localization can be enabled per company, providing capability to have multiple localizations in the same tenant. all localizations are updated based on changes in laws and regulations in each region.

-

Limits custom developments and reduces the cost and complexity of your system, as the solution provides many functionalities that are not available in the standard version.

-

Speeds up the implementation process, as the solution is easy to install and configure, and does not require any coding or scripting.

-

Improves the quality and accuracy of your data and reports, as the solution allows you to add more fields, dimensions, and validations on your records and transactions.

-

Enhances the usability and efficiency of your system, as the solution offers automation features, document management, and electronic signature integration.